+91 9318406647

info@iameya.in

Follow Us On :

Home Biz Cashwise (Expenses Management)

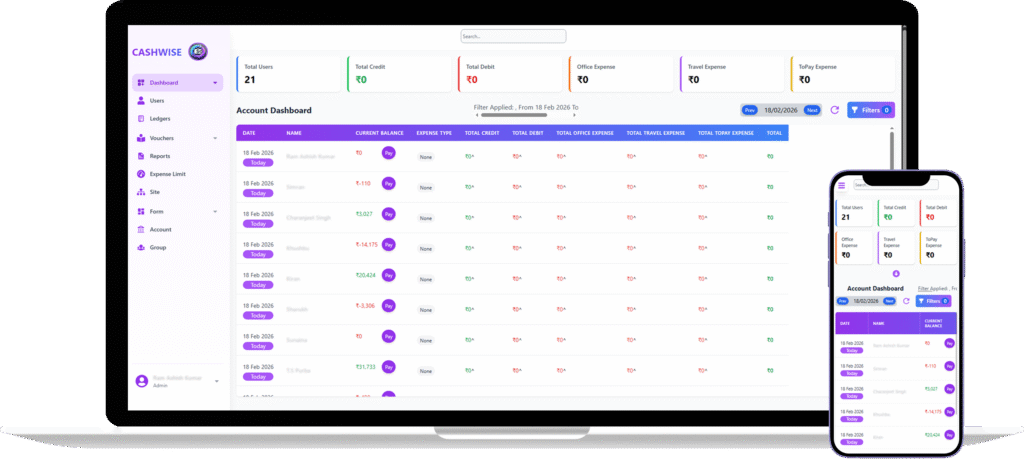

Biz Cashwise: Smart, Automated Expense Management for Modern Teams

About

Manual expense handling often leads to delays, errors, fraud, and poor financial visibility. Biz Cashwise transforms this with an AI-backed, automated expense management system that centralizes all transactions, accelerates approvals, and provides real-time control over company spending. From receipt uploads to credit/debit tracking, Biz Cashwise ensures every rupee is accounted for — transparently and effortlessly.

Challenges

01. Expense Visibility Issues

No centralized view of employee expenses causes confusion and poor financial control.

02. Manual Approval Delays

Traditional approvals slow down reimbursements and demotivate employees.

03. Unorganized Expense Records

Paper receipts and spreadsheets often lead to losses, misreporting, and audit issues.

Key Features

01. Expense Submission & Tracking

Employees can submit categorized expenses (travel, food, marketing, etc.) using a simple form. Managers get instant visibility, enabling faster approvals and accurate reimbursements.

02. Automated Approval Workflow

Eliminate bottlenecks with automated routing of expense claims. Approvals are quicker, more transparent, and fully compliant with internal financial rules.

03. Centralized Cash Management

Access real-time dashboards showing balances, credits, debits, and overall cash movement. Both admins and employees have clear visibility into their financial status.

04. Receipt & Bill Uploads

Users can upload supporting receipts and bills, making audit trails seamless and reducing mismanagement or missing documentation.

05. Credit / Debit Tracking

Track incoming and outgoing funds for each employee or department. Biz Cashwise logs every transaction for accurate budgeting and financial auditing.

06. Role-Based User Management

Assign permissions based on staff roles such as employee, manager, or admin. Sensitive financial data stays protected, and users see only what they are authorized to access.

07. Group & Department Expense Control

Set spending limits for individuals or departments. Monitor usage patterns and ensure teams stay within approved budgets.

08. Financial Reporting & Analytics

Access complete transaction histories, generate expense reports, and analyze spending trends. (Upcoming: automated budget limits & proactive overspend alerts.)

Outcome

0%

Reduction in Expense Processing Time

Automation speeds up submissions, reviews, and reimbursements.

0%

Eliminated 90% of Manual Tracking Errors

Digital logs reduce human errors and ensure accuracy.

0%

Prevented 15–20% Expense Fraud & Over-Claims

Real-time tracking and documentation ensure compliance and integrity.

Technologies Used

React JS

Next.js

Node.js

MongoDB

Python

Visual Studio

Tally Integration

AWS

Play Store

App Store

Nest.js

PostgreSQL

See how our product fits your exact business needs.

Download

Brochure

Quick Call Us:

+91 9318406647

Mail Us On:

info@iameya.in

Visit Location:

T3-531,532-Golden I, Sector-Techzone 4, Greater Noida West, Gautam Buddha Nagar-201306 India